Most countries in Europe are now in lockdown (either a hard one or a soft one) and our freedom of movement has been severly limited. The financial markets have taken a serieus beating it probably also feels as if our financial freedom has been limited as well. But personally I do not look at it this way.

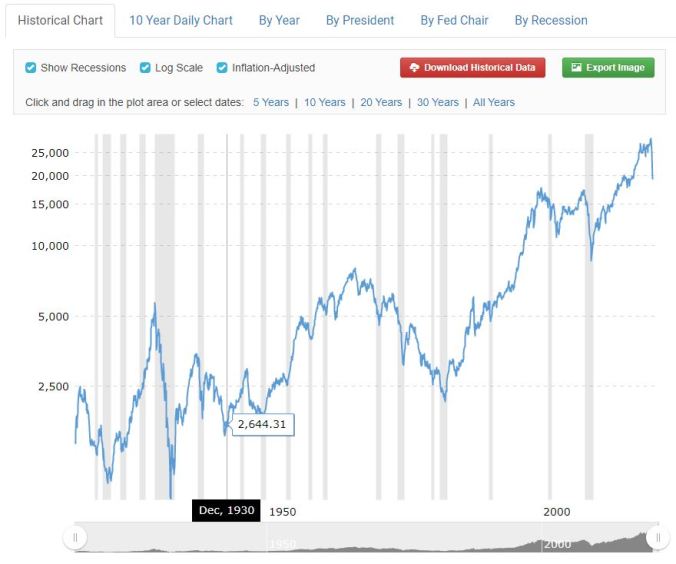

As far as the stock market crash goes: this too shall pass. I have been investing long enough to witness the dot com crash and the 2008 financial crisis and I can assure you that a few years from now the current market panic will mostly be forgotten. Probably replaced by an all new ‘crisis’ dominating the headlines.

As far as striving for financial freedom goes, the current crisis has only strenghtend my resolve.

For me, those who already achieved financial freedom are those who are the least impacted by all of this. They had the lowest change of getting sick since they had no need to commute to work. And now that the lockdown is in effect they do not have to worry about their job or income. They also have the most flexibility time wise to take care of their children if the schools in their area are closed, to help others or to explore other more local leisure activities. Actually, there is a good change they allready know those locale activities. The lockdown is, in a way, is forcing more people to live like a mustachian: no more eating out, bike more, live your live more locally …

Which brings us to the people trying to get to financial freedom. Mr Money moustach proposes to live close to work (and thus not waste hours commuting) and I for one am pretty happy I no longer needed to take public transport to go to work. Something tells me that my infection risk was a lot lower on my Vespa then it was on our overflowing commuter trains.

Since all of us in the FIRE community live below our means we also have the financial resources to gt through this crisis. We can afford to buy all we need. The worst that can happen to us is that the most frugal option is not available. But the only impact that will have is on our savings rate. For people living paycheck to paycheck the impact will be real and will mean not being able to buy food or pay rent/mortgage, utility bills …

Already news articles are starting to appear that it is the poor that are being impacted the most by the lockdown. Estimates are that around 1 million Belgians will end up on temporary unemployment? At the moment around 600,000 already are. Our government has boosted the pay-out as the temporary unemployment system was never meant for prolonged periods of time and for these big numbers. The max pay out was 1 450 euro a month and has been pushed to 1 600 euro now. For me this would fall within my self imposed monthly budget and I would be fine. A lot of others will not be. Our government has also promised help with utility bills and asked banks to be flexible in regards to mortgage payments and such. This indicates that our government knows that lots of people will not be fine finance wise. We in the FIRE community are the lucky ones. Or at the very least, the well prepared ones.

For me personally the impact at the moment has been very limited. We have always bought our non-perishables in bulk as that is the most frugal/efficient way to buy that kind of stuff. The only difference was that instead of using those bulk purchases completely before buying new I resupplied two weeks back when only half was used up. And the only reason for this was convenience as I wanted to avoid the supermarkets when the shit hit the fan. So we had a well stocked pantry when the hoarding commenced. I looked at the long lines outside supermarkets on television and was glad to be a lazy, frugal weirdo because sloths do not do long waiting lines!

I also bought extra animal feed as the bags weigh 25 kg which makes me the only person being able to carry them and I wanted to avoid having to lug those around if I fell sick. Again, a decision based in convenience and laziness and not fear of stuff running out.

I work from home now so my income will not suffer. It would take a complete and total economic collapse before my company would move us to technical unemployement (actually, in that case we would probably have more work ..). The girlfriend works in healthcare and as such has a decent job security at the moment. So our income will not suffer.

Health wise we are fine for the moment. With one confirmed Covid 19 infection at the girlfriends workplace, chance is high she will fall sick in the coming weeks. We will see if the government has plans to boost that pay-out too, But if not, as mentionned above, only our savings rate will suffer …

Recent Comments